Coexistence of ETS with other policies: Challenges and opportunities

In the past, emissions trading systems (ETS) have sometimes been seen as a silver bullet to address GHG emissions effectively and at relatively low costs. While this thinking still prevails in some circles, more and more it is becoming clear that while ETS can be an important instrument, a broader, and consistent policy package is needed to drive low-carbon development on a sufficiently large scale. Also, when an ETS is introduced, often other policies are already in place, with their own objectives and vested interests.

The successful co-existence of an ETS with other policiesand targets requires careful attention in design and/or transition to ensure synergies, limit negative side effects and improve public acceptance. Here we share some experiences with co-existing policies in the EU and lessons learned in the context of a project supported by the German Environment Agency UBA.[1]

By Dian Phylipsen, SQ Consult

Potential issues with co-existence of ETS and other policies

When an emissions trading system and other policies are in effect simultaneously, they can help achieve the respective policy goals, e.g. when the carbon price incentive on its own is too low to drive sufficient change. However, multiple policies directly or indirectly affecting the same sectors or actors can also lead to a number of issues. Partly these relate to the effectiveness of the instruments to achieve their objectives, partly to the efficiency with which the targets are achieved (and public money is spent). In addition, some issues deal with the effect of multiple obligations on the stakeholders involved.

In terms of effectiveness, the carbon price incentive of an ETS can be blunted if other policy measures limit the pass-through of carbon costs down the supply chain, e.g. by regulating energy prices or subsidising or compensating increased energy costs. Other policies leading to lower emissions in specific ETS installations are often mentioned to lead to the so-called “waterbed effect”, where such emission reductions will lead to higher emissions elsewhere in the system (below the cap). Multiple applicable policies can also lead to double-counting or double-dipping. Double-counting can present a problem if the emission reduction impacts of multiple policies get counted twice and as a consequence, actual emission reductions are lower than reported. In most cases, however, double-counting is used when in fact double-dipping or double-rewarding is meant. In this case, the same actor gets rewarded multiple times through each of the policies for the same action. This is not an environmental issue, but it can be an issue in terms of the efficient use of public funding, if total support is higher than needed (free rider effect). Finally, multiple instruments can mean multiple obligations for the affected stakeholders, both in terms of compliance and reporting obligations.

Co-existence at the EU level

In the EU, the EU Emissions Trading System (EU ETS) is seen as the ‘corner stone’ of the EU’s climate policy and ‘its key tool’ for reducing greenhouse gas emissions cost-effectively in the affected sectors. However, separate policy targets and instruments have been in place in parallel at the EU level, addressing total (economy-wide) GHG emissions, the share of renewable energy (RE) in total energy consumption and energy efficiency (EE).

Interaction with other policy targets

Even though various impact assessments suggested total higher mitigation costs for simultaneous GHG, RE and EE targets at the EU level[2], this decision was made in recognition of the importance of other, non-GHG policy targets. This includes, amongst others, security of supply in the electricity sector, reduced import dependency for fossil fuels, addressing (other) air pollutants, innovation in clean technology, employment and green growth. Actions towards meeting these policy targets are in turn also expected to help support the longer-term transition to low-carbon development in the ETS sectors.

As a result of the above, some ETS sectors are affected by more than one policy (target). An example is the energy sector, which is also expected to play an important role in reaching renewable energy targets. Similarly, industry will also have to contribute to energy efficiency (and biofuels) targets. However, the EU RE targets are generally translated into RE targets at the Member State level and achieved through individual policy instruments implemented by Member State governments. The specifics of such national policies ultimately determine which stakeholders are affected and the required effort. A specific RE policy may focus for example on EU ETS participants, on specialized RE producers or suppliers (not covered by the ETS) or on consumers. The choice for e.g. portfolio standards or investment grants determines the ‘burden’ for the actors addressed by the policy. So the extent to which EU ETS participants are subject to additional compliance and/or reporting requirements due to other policies depends on the EU Member State. This also applies to the extent to which mitigation in EU ETS installations is also rewarded by other policies.

In terms of the target of the EU ETS (the cap), the effect of other targets and policies has in principle been taken into account in the setting of the EU-wide cap[3] (as far as they were in place at the time of cap-setting). In other words, emission scenarios and mitigation costs that were used to decide on the level of the cap included measures to achieve also the other policy targets for total GHG emissions, RE and EE. While no individual policy measures were identified in this context, it can be argued that as long as the EU targets on renewable energy and energy efficiency are not yet reached, implemented RE/EE policies are the vehicles towards achieving these targets, and are therefore reflected in the cap. This would then not constitute a water bed effect.

The revised ETS Directive, applicable as of 2021, does contain a specific provision out of concern for a possible water bed effect due to the phase out of coal-fired power plants: EU Member States can voluntarily cancel equivalent amounts of allowances it can auction “In case of closure of electricity generation capacity in their territory due to additional national measures” (Art.12.4)[4].

EU ETS and JI projects

Joint Implementation (JI) allows all Annex I countries under the UNFCCC to implement emission reduction projects to generate Emission Reduction Units (ERUs) for use by other Annex I countries for compliance. As these projects were expected to occur in countries in transition (Eastern Europe, Russia, Ukraine, etc.) and not in the EU, this was not considered an issue when the EU ETS Directive was adopted in 2003. This changed, however, with the accession of new Member States from Eastern Europe in subsequent years. This highlighted that JI was a de facto (regional) domestic offset mechanism, co-existing with the EU ETS. This led to concerns of potential double-counting of emission reductions in case of JI projects in EU ETS sectors, i.e. emission reductions that would result in both ERUs as well as excess EU allowances that could both be used for compliance or sold separately. To prevent this, the so-called ‘Double-counting decision’ was adopted, as part of the Linking Directive[5] that regulates the relation between the EU ETS and the Kyoto Mechanisms.

The main principle of the decision is that greenhouse gas emission reductions (or limitations) should not be allowed to be counted (and sold) twice. As the Acquis Communautaire[6] requires accession countries to adopt all EU legislation, compliance under the EU ETS should be considered the baseline for JI projects. The decision therefore prescribes that no ERUs (or CERs) can be issued for reductions (or limitations) of GHG emissions that take place in installations participating in the EU ETS. An exception was made for early projects already committed to by Member States, as contractual obligations were already in place for such projects. ERUs/CERs could be issued until 31 December 2012 on the condition that corresponding amounts of EU allowances would be cancelled. Note that this cancellation was required for both ‘direct’ JI projects (projects in EU ETS installations) and ‘indirect’ JI projects (projects indirectly affecting emissions from EU ETS installations, e.g. through electricity conservation).

Co-existence at the Member State level

At the national level, several national policy instruments were introduced while the EU ETS was operational to support additional policy objectives. Also, some policies were already in place at the EU ETS introduction and continued to exist in parallel, in some cases in revised form.

The UK Carbon Pricing Support mechanism[7]

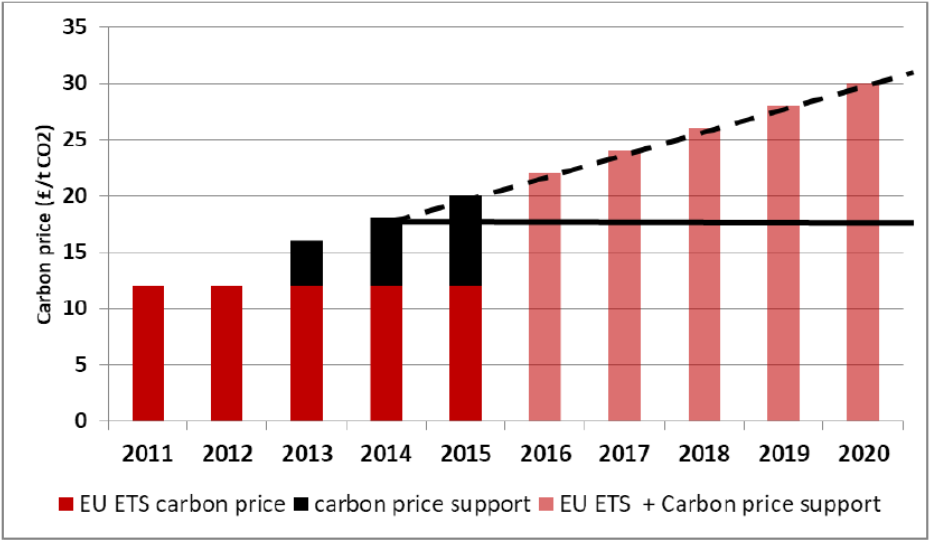

The UK’s Carbon Pricing Support (CPS) mechanism imposes a carbon tax on fossil fuels used to generate electricity in the UK. It was implemented in 2013 to support the EU ETS and strengthen its carbon price incentive as to contribute to the UKs long-term GHG targets. The CPS basically introduces a carbon price floor for the electricity sector in the UK. As the prevailing EU ETS carbon prices were deemed insufficient to drive low carbon investment, the Carbon Price Floor (CPF) was introduced to establish a minimum price level, which increases over time, and provide investors with more long-term certainty. The price floor consists of the EU ETS allowance price and the Carbon Support Price, which tops up the allowance prices to the carbon floor price target. This target level was set at £9/tCO2 at its introduction in 2013, increasing to £18/tCO2 in 2015. While initially intended to increase to 30/tCO2 in 2030, competitiveness concerns led to a freeze of the CPF at this level until 2020. The CPF is implemented as part of the Climate Change Levy (CCL)[8].

The CPF uses Carbon Price Support rates to establish the regulated entities’ tax liability. CPS rates, which are set three years in advance, are provided for different fuel types on a £/kWh basis. This is calculated by multiplying the difference between the target carbon price and the market price. This represents the CPS rates by carbon content (i.e. per tonne of CO2, the black bars in Figure 1). This is then multiplied by standard carbon emission factors (in tCO2/kWh), which gives a CPS rate per KWh, to be paid by electricity generators. Note though, that at the same time, the UK government has sought to shield energy-intensive industry from the increased price of electricity, by extending its ‘Energy Intensive Industries (EII) Compensation Package’[9] to include not only the effects of the EU ETS, but also of the CPF. This includes £110 million to compensate for the impact of the EU ETS (£2.50/MWh) and £100 million for the UK’s Carbon Price Floor (£10.50/MWh) for the period April 2013 to March 2015.

The Netherlands’ negotiated agreements on industrial energy efficiency[10]

The Netherlands has a long history of using negotiated agreements between industry and government as part of its energy policy. As of 1999 the energy-intensive industry (<0.5PJ/yr) and the electricity sector were covered by the Benchmarking Agreement. Instead of the annual EE improvement rates used in previous agreements, the benchmarking agreement adopted an EE level to be reached in the target year 2012, defined in terms of ‘top-of-the-world’ performance (the best 10% of a benchmark curve of comparable peers). The rationale for this approach was that once companies belong to the ‘top-of-the-world’ limited additional improvements could be required from them.

When the EU ETS started, the Dutch government kept the Benchmarking agreement in place but sought to account for early efforts by its participants in the national allocation decision by adopting a bonus/malus approach[11]. Companies participating in the agreement received an increase (bonus) or a decrease (malus) in allocation compared to the base allocation, so that total allocation does not increase but allowances are only redistributed to benefit those who have undertaken early mitigation action. At the same time, the government strove towards getting explicitly benchmark-based allocation approaches adopted more broadly in the EU ETS to allow the recognition of early action across all ETS participants. Such approaches were ultimately adopted in the revised ETS Directive of 2008-2009, effective as of 2013.

With the policy approach now very similar to the EU ETS, the Benchmarking agreement was no longer needed to ensure fair treatment of early action by Dutch companies participating in the EU ETS. The agreement was replaced in 2009 by the ‘Long-term agreements on Energy efficiency for EU ETS companies’ (LEE), in which participants are still required to implement all profitable measures[12], but only ‘soft’ (not binding) energy efficiency improvement targets are included. Companies are to investigate long term energy-saving possibilities at the strategic level, including measures across their value chain. As such, the LEE agreements aim to support the short-term incentive to reduce emissions for its participants in case of insufficient carbon prices (requirement to implement profitable measures) as well as the long-term incentive to influence transition in both ETS sectors and the wider economy (long-term measures, supply chain measures).

Italy’s white certificates scheme[13]

The Italian Tradeable White Certificate (TWC) scheme was the first to be implemented in the world, in 2005, with the aim to improve energy efficiency and reduce emissions in all energy end-use sectors. Under the scheme, distribution companies must meet specified energy savings targets, either by implementing energy conservation projects with their customers, thereby generating white certificates, or by purchasing white certificates on the market. The target for individual gas/electricity distributors is fixed at the beginning of the year in proportion to its market share. The white certificates are issued after certification that savings have occurred and are eligible under the scheme. The system also allows voluntary participation by e.g. energy service providers. The latter have actually been responsible for up to 80% of the achieved energy savings, subsequently selling the resulting white certificates to the regulated distributors. Distributors can pass the costs incurred by the scheme on to customers, within limits imposed by the regulator.

Savings achieved under the scheme must be additional to measures that would normally be implemented, including those implemented to meet new legal requirements (i.e. the baseline is continuously updated). The additionality of EE measures is determined by ENEA by defining a market and regulatory baseline for each technology. The baseline takes into account the average performance of the technology on the market, the expected technological progress, minimum legal requirements and the energy consumption before project implementation. In the early phases of the system, the additionality of certain eligible measures was questionable (e.g. CFLs) and this was likely a factor in a significant oversupply of white certificates and subsequent low certificate prices at that stage[14]. To address additionality concerns, eligibility criteria for CFLs were gradually tightened, until they became ineligible in 2011.

Over the years, various legislative changes were implemented, extending the duration of the scheme, increasing the ambition level of the energy saving targets, revising the eligibility of saving measures and changing the period over which projects can generate white certificates. At the end of 2011, 60% of the certificates issued since the launch of the mechanism were from electricity saving activities. This led to criticism of double counting, or at least double rewarding, the effects of measures implemented in the electricity sector, where also ETS allowances are freed up as a result of those measures. In 2012, the rules for the amount of certificates that a project generates changed, resulting in improved economics of energy efficiency investments and a strong surge in industrial energy efficiency projects and a significant overlap with industrial ETS sectors. The share of certificates from industry rose from 6% in 2007 to 62 % in 2015 (predominantly paper, glass & iron and steel). In 2017, this rule change was reversed again, further tightening additionality rules[15].

Lessons learned

The above EU examples suggest there can be different arguments for having an ETS co-existing with other policies:

- Achieving multiple objectives: governments have multiple policy objectives, which cannot be achieved by any single policy, for example the economy-wide energy saving objectives of the Italian white certificate scheme;

- Reducing market failures to improve the efficiency of the EU ETS, such as an insufficient carbon price incentive, insufficient possibility of cost pass-through or high transaction costs. The UK Carbon Price Floor Mechanism is an example of such a policy, while for long-term innovation also policies such as R&D or investment subsidies are relevant;

- Improving the design of the ETS, for example to achieve a fairer allocation, such as the case of the Benchmark agreement in the Netherlands or to provide more flexibility in compliance by means using offset credits;

- Honouring existing agreements or contracts by governments or obligated entities, such as the voluntary agreements in the Netherlands and JI projects in new EU Member States.

As shown by the above examples, negative impacts of policy overlaps on the ETS can be prevented by smart policy design, including:

- Taking the impact of other policies into account in the cap-setting for the ETS;

- Incorporating price control mechanisms to limit unintended downward pressure on the carbon price (price floors, market stability reserves, voluntary allowance cancellation by government);

- Adopting qualitative or quantitative limitations on the eligibility of e.g. energy saving and/or emission reduction activities in a white certificate schemes or domestic offset mechanisms.

It the context of double-counting, or more aptly named ‘double rewarding’ (also called ‘double dipping’), it needs to be considered to which extent, or in which cases, this poses a problem. When an emission reduction measure is sufficiently incentivized by an individual policy instrument to be implemented, rewarding the same action through another policy instrument would comprise a waste of public money. However, if the incentive provided by a single policy instrument is insufficient to result in implementation of the measure, a second policy instrument can strengthen the incentive, thereby supporting the realization of the measure. This can be seen as achieving synergy, rather than as double-counting or double-rewarding. In any case, it is important to carefully track the extent to which double-dipping occurs. This way, public perception in this regard can be managed or adjustments can be made in case over-incentivization does threaten to occur.

[1] “Perspectives on linking emissions trading systems: options for transitioning domestic climate policies into an ETS”, carried out by a consortium of Wuppertal Institute, Perspectives and SQ Consult, see: https://www.umweltbundesamt.de/en/publikationen/how-can-existing-national-climate-policy.

[2] Compared to a GHG-only target, see e.g. the Impact Assessments for the 2020 Climate & Energy Package and for the 2030 Climate and Energy Framework, see: https://ec.europa.eu/clima/sites/clima/files/strategies/2020/docs/sec_2008_85_ia_en.pdf and http://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52014SC0015&from=EN

[3] Since the start of Phase 3 in 2013.

[4] https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32018L0410&from=EN

[5] Formally a 2007 amendment of the 2003 ETS Directive: http://eur-lex.europa.eu/LexUriServ/LexUriServ.do?uri=CELEX:32004L0101:EN:HTML

[6] The cumulative body of European Community laws, comprising the EC's objectives, substantive rules, policies and, in particular, the primary and secondary legislation and case law – all of which form part of the legal order of the European Union (EU) with which all Member States must comply.

[7] See e.g. http://researchbriefings.parliament.uk/ResearchBriefing/Summary/SN05927#fullreport, https://www.gov.uk/guidance/climate-change-levy-application-rates-and-exemptions#carbon-price-support-rates

[8] The Climate Change Levy (CCL), introduced in 2001, is a tax applied to energy consumption by companies and public sector organisations, automatically added to their energy bills. Regulated entities can be partly exempt from paying the CCL by participating in Climate Change Agreements (CCAs), voluntary agreements with the UK government with targets for energy efficiency improvement or CO2 emission reductions. Before the introduction of the CPF, electricity generation was exempted from the CCL.

[9] Aimed at providing support to eligible energy intensive industrial sectors to assist with impact of energy and low carbon policies on energy bills. A support package worth £250m was announced in 2011 originally due to start in 2013. It was approved by the European Commission as in line with State Aid guidelines in 2015.

[10] See e.g. IIP’s Industrial Energy Efficiency Policy database: http://iepd.iipnetwork.org/country/netherlands

[11] This decision was in part informed by an extensive 2003 analysis of the potential interaction between the EU ETS and existing national policies and possible scenarios for co-existence, carried out by ECN: https://www.ecn.nl/docs/library/report/2003/c03060.pdf

[12] With payback periods of five years or less as identified in the mandatory energy efficiency plan.

[13] See e.g. https://www.iea.org/media/workshops/2011/aupedee/Paolo_Bertoldi.pdf, http://www.energy-efficiency-watch.org/fileadmin/eew_documents/EEW3/Case_Studies_EEW3/Case_Study_Manager_White-Certificates_Italy_final.pdf, https://www.diw.de/documents/publikationen/73/diw_01.c.529897.de/dp1565.pdf

[14] CFLs accounted for 50% of the cumulative savings between 2005 and 2010.

[15] https://www.jdsupra.com/legalnews/white-certificates-new-regulation-on-24527/